First Class Info About How To Be Vat Registered

New vat taxpayers shall apply for registration as vat taxpayers and pay the corresponding registration fee of five hundred pesos (p500.00) using bir form no.

How to be vat registered. Your total vat taxable turnover for the last 12 months was over £85,000 (the vat threshold) you expect your turnover to go over £85,000 in the next 30 days. If you have decided that becoming vat registered is the right thing for you and your business, you will need to register with hmrc. How to become vat registered.

If a person is required to be registered for vat or if he wishes to apply for voluntary registration, he must download from mra website, the appropriate application for registration form as. The rules for vat registration are complex and differ from country to country. Registration for farmers and agricultural services.

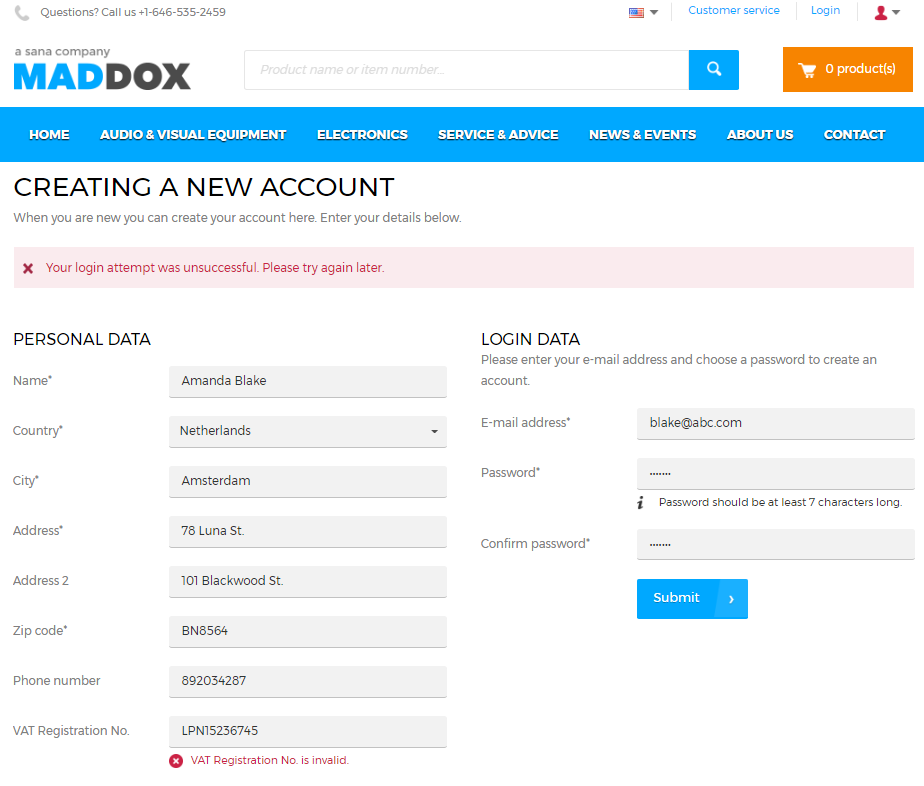

Should i become vat registered? Choose the icon, enter purchase order, and then choose the related link. To register vat on a purchase order.

If you take over a vat registered business, or part of a vat registered business, from somebody else as a going concern, you may be liable to be registered (see paragraph 3.8). If a business has not registered for vat, it will have no vat number or requirement to include this on the invoice. You must complete a vat registration form and submit supporting documents to the inland revenue division at the address below.

While any business can choose to register for vat, it’s only compulsory if your. The majority of businesses register online through the hmrc website using their government gateway login. If you own the vat registration, sign into your vat online account using your government gateway id and password.

The person required to register for vat must file a. If you already have a vat registration number, you are not required to re. Registration provisions apply to any natural or legal person conducting business in the uae, even if the person has no trade licence.

You must register for vat with hm revenue and customs (hmrc) if your business’ vat taxable turnover is more than £85,000 in a rolling 12 month. Charge the right amount of vat to your customers. On the shipping fasttab, fill in.

As part of the process, you will. You’ll need to select ‘cancel vat registration’. Generally speaking, though, if a business exceeds 85k worth of tax turnover, it usually means it’s legally required to.

There are a few ways you can register for vat. Sole proprietors must fill in the form a. How to register for vat.

Select the relevant purchase order. Pay any vat due to hmrc. Threshold to join scheme threshold to leave scheme;